Car Buyers Guide: 7 Steps to Buying Your Next Car

Congratulations on your decision to buy a car!

It can be a fantastic and exciting time, however it can also be very overwhelming and plagued with challenges and unforeseen events. This guide will help take the guesswork out of purchasing a car privately.

If you have questions you need answered about the car buying process and want to make sure

you get the best deal, then this guide is for you!

Whether you’re just starting to think about buying a car, or have found the perfect car for you but don’t know where to go from here, this guide will answer many commonly asked questions about buying a car as well as provide essential information to guide you through every step of your exciting journey.

You will also find handy little tips and facts as well as useful checklists and links to the required information to help guide you seamlessly through the process of purchasing a vehicle.

In this guide, you will learn...

- Tips to help choose the right car for you

- Arranging your finances

- Handy questions to ask a seller

- What to look for on a test drive

- 100 point vehicle mechanical inspection guide

- How to avoid buying a written-off or stolen vehicle

- Tips to negotiate the best price

- Ways you can protect yourself and your vehicle

Read the Guide to Selling a Used Car in QLD

1. Arranging Your Finances

Before you begin looking at cars, let’s take a step back and look at how much you can spend.

A lot of people start their journey by looking at hundreds of vehicles off the bat, become quickly

overwhelmed and some even go on to make an emotional buying decision that may not always

end up being the best choice for them.

Before you begin looking at cars, let’s take a step back and look at how much you can spend.

People tend to brush over this step, however, it is a vitally important step to do early on in your

journey.

If you’re paying cash for your car, great - you know exactly how much you can spend. If like the

majority of the population, you’re choosing to finance your car, it is important to start looking

for finance early to avoid stress and possibly miss out on the car of your dreams.

Get A Pre-Approval

Whether you choose to obtain your vehicle finance through us or your bank, now is the time

to get in contact to start the finance ball rolling.

Having a pre-approval puts you at a great advantage to negotiate with the seller for the best price on the perfect vehicle knowing exactly how much you have to spend and that the money is effectively ‘in your pocket’.

It also ensures that when you find the car that is right for you, your finance in most cases can be completed or settled with funds transferred to the sellers account usually within 24 hours. Private sellers usually want a quick sale so they don’t have to spend too much of their free time and this can potentially help you to negotiate a better price.

2. Choosing The Right Car For You

There are so many cars out there to choose from! How do I find the perfect one for my needs?

This is a common question, but the answer is that one size definitely doesn’t fit all when it

comes to cars.

Budget

Make sure you have considered the information in step one above to help you choose your budget. If you are financing your car, it may be easier to work in weekly or monthly repayments, rather than overall cost.

Consider your existing liabilities and commitments including current loans, living expenses and rent or mortgage payments to establish how much you can afford to repay. You can use our handy loan repayment calculator to give you a general guide of what your loan repayments will likely be.

Don’t forget to include additional costs such as vehicle insurance, fuel, routine servicing and maintenance items such as tires. Make sure the repayments, as well as ongoing vehicle costs, fit within your current budget.

Requirements

Once you’ve established a suitable budget, now you need to work out exactly what you need in a car. A tradesman who needs to carry his tools around every day probably wouldn’t be looking for a little hatchback. Similarly, you need to take a look at your lifestyle and what you will be using

the car for.

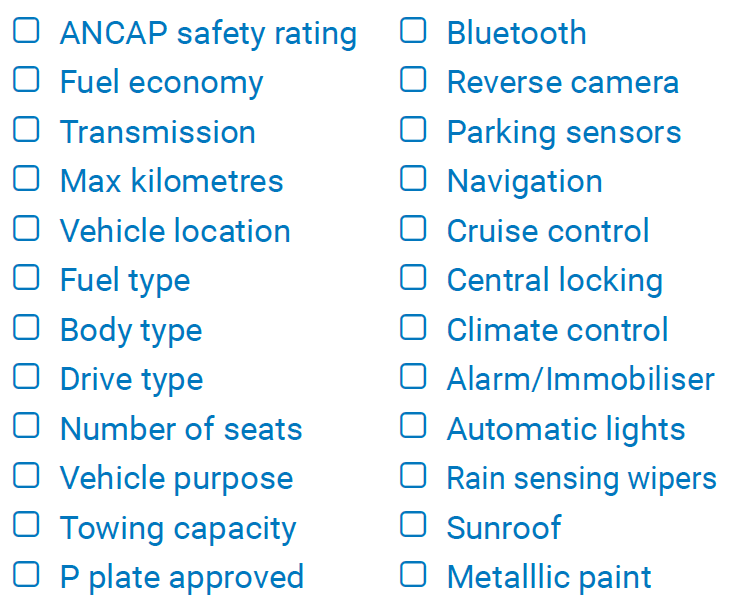

Make a list of the things that you need versus the things that you ‘want’ in your next vehicle.

Consider how many people you will need to take. Use the checklist below to help determine the things that are important for you to have in your next vehicle.

Related Reading: 5 Things To Consider Before Buying Your Next Car

3. Asking The Right Questions

Once you have narrowed your vehicle search down till there’s only a few contenders, it is time to start researching your choices.

To help you decide which ones you want to test drive, the easiest way to find out the good, the bad and the ugly about each vehicle model is to research what other owners have to say about their experience through vehicle reviews.

There are a number of authority sites that can provide you with honest reviews and feedback from actual people who’ve owned the vehicle models you’re looking at. It is a great idea to read vehicle reviews prior to viewing each vehicle so you know any common problems they may have and exactly what to look out for. Some review sites may even give you a guide as to the medium price.

A few review websites to check out are...

Contact The Seller

Once you have narrowed down your search and are happy with the reviews on your chosen vehicles, it is time to contact the seller directly.

Before you even consider going to see the car or taking it for a test drive, you can ask the seller questions to help you understand the general condition of the car. Sometime just talking to the seller can give you a good gauge whether the vehicle has been properly maintained and if they’re likely to be negotiable on the price.

Little things that come up in conversation such as that they’re in a rush to sell or that they don’t have logbooks for the car can prove to be very powerful negotiating tools when it comes time to agree on a price.

Questions to Ask The Seller

- Why are you selling the car?

- Is there finance currently owing on it?

- How long have you had the car and are you the first owner?

- When is the next scheduled service due?

- Do you have the vehicle logbooks?

- Is the registration current and when does it expire?

- Does it come with a Road Worth Certificate and registration?

- Has the car ever been in an accident?

4. Taking The Test Drive

Once you’ve spoken to the prospective sellers, it’s time to take them for a test drive.

Before you take any vehicle for a test drive, there are two vitally important points to check with the seller.

Firstly, make sure the registration is current. This is important to ensure you don’t receive a fine for driving an unregistered vehicle. Lastly, check that the seller has adequate comprehensive insurance cover that will also cover you as a driver.

If their insurance doesn’t cover all drivers, you may need to request that they add you to their policy temporarily as a driver. This ensures that in the event of an at-fault accident, you are covered by insurance and only liable to pay the excess premium and not the entire cost of the car in addition to any damage you do to other vehicles or property.

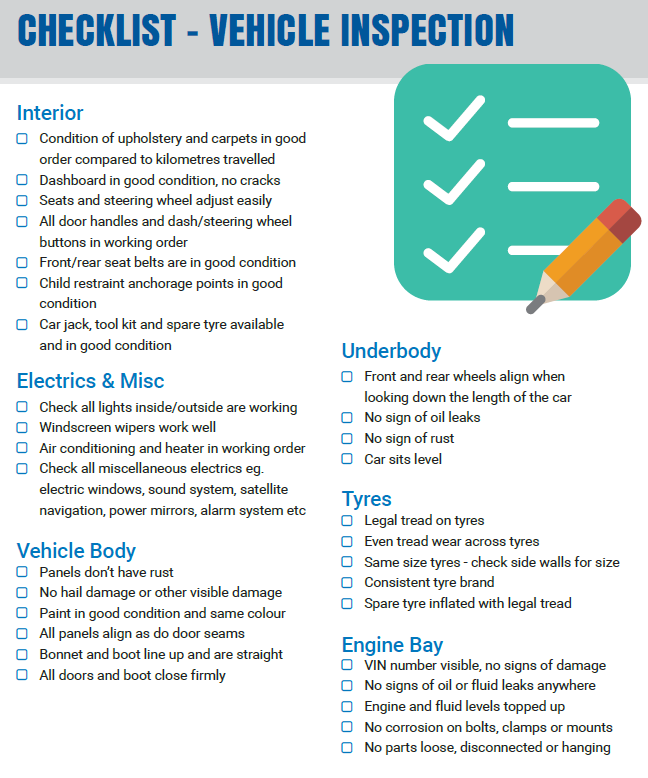

It is generally a good idea to arrange test drives and vehicle inspections during the day so you have adequate light to thoroughly inspect the car. Prior to embarking on your test drive, make sure you inspect the vehicle using the vehicle inspection checklist on the next page. Use it to note down any issues or problems you see with the car.

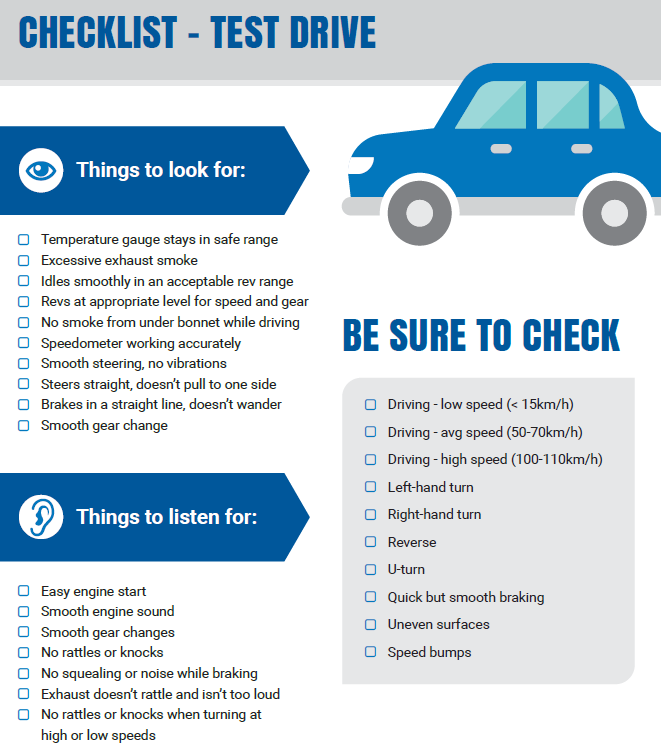

Alternatively, there are companies for a fee that offer vehicle inspection services such as RACQ, Marshall Batteries or many others. Once you have completed a thorough inspection of the vehicle and are confident that it has suitable registration and insurance, you’re now ready to take it out for a test drive.

It is advisable that you take someone with you as a second pair of eyes and ears who may pick up things you miss while driving. It is also advisable that you test the car through varying speed zones and across different surfaces such as speed bumps to adequately check the car’s vital components.

5. Vehicle Research & Authentication

Thousands of people every year in Australia purchase vehicles thinking they’re buying their dream car only to find out that it has previously been in a significant accident and repaired or even in some cases stolen.

Another unfortunate but common occurrence is finding out that a finance company has an encumbrance or security over the vehicle. Even though you are the new owner of the vehicle, a finance company with security over the vehicle can still repossess the vehicle if there is money owing by a previous owner.

All of these scenarios can have a seriously devastating impact upon you and your vehicle and put a major dampener on your car buying experience.

Get the facts on your vehicle

Fortunately, there is a very simple way to check the history of your car to find out if it has ever been listed as stolen, written off or currently has any encumbrances from finance companies. The Personal Properties Security Register (PPSR) is a national government register that can provide information to help protect consumers when they are buying personal property such as cars or boats.

A PPSR certificate will show the following information for a vehicle:

- Vehicle make, model, colour

- Vehicle registration details

- Written-off vehicle notifications due to

- accident, fire, flooding etc

- Stolen vehicle notifications

- Financiers with security over the vehicle

Get A Free PPSR Vehicle History Check

What Is A VIN And How Do I Find It?

Every vehicle produced after 1989 will have a VIN (formally known as a REVs check), it is the vehicle’s unique serial number and is used to identify individual vehicles. A car VIN will always be 17 characters long, will never contain the letters “I”, “O” or “Q” and will usually be a mix of letters and numbers.

If the vehicle was produced before 1989, it will have a Chassis Number instead. It is always important when checking a vehicle’s VIN that you check for any signs of tampering such as scratching and grind marks. If the vehicle shows any signs of tampering, it is best to steer well clear of it, no matter how good the deal may seem.

6. Making The Purchase

If you’re satisfied with the Vehicle History Check and all other aspects of the vehicle, it is now time to consider making the purchase.

After completing your research on the vehicle, performing a PPSR vehicle check, completing your inspection of the vehicle and taking it for a test drive, if you are now satisfied that it is the right vehicle for you, it’s time to make the purchase.

The purchase is the part of the journey that most people stress about the most, but in truth, if you have completed the steps outlined above, you can be confident your vehicle is in good condition.

When it comes to negotiating a price, some people tend to get overwhelmed and flustered, so following steps below may help to take the guesswork out of making an offer.

Know The Average Vehicle Price

Use a site like Redbook to help you determine the average sale price of the vehicle you intend to purchase. You can also use sites like Carsales to gauge how much similar vehicles to yours in the same condition are currently listed for. Remember to take into consideration the kilometres and overall condition.

Make A Realistic Offer

Use all the information you have on the car, such as your inspection checklist and test drive checklist to identify any money you may potentially have to spend on the car and take these things into consideration when making your offer. It is ok to use these items to genuinely explain how you calculated the figure you are offering.

The most important thing to consider before submitting your offer is that it fits within your

budget. It is also important to consider any additional changes you may incur when choosing a private sale vehicle such as registration transfer fees, stamp duty and the costs involved with getting a safety certificate if the vehicle doesn’t already have one.

For more information on the fees and charges for transferring ownership of a vehicle, visit your state’s Transport Authority by selecting your state below.

QLD | NSW | VIC | NT | SA | WA | ACT | TAS

Negotiate

In general, sellers don’t tend to take the first offer, therefore it is likely that negotiation will have to take place. Remember that there are plenty of vehicles out there and you can’t let emotions dictate the outcome of the negotiation. If you have submitted a fair and genuine offer, you will usually end up with an agreed price somewhere in the middle of your offer and the asking price of the vehicle.

Complete The Paperwork

Once you have come to an agreed sale price, it is important to get it in writing to avoid any

misunderstanding or attempts at further negotiation. You can use the private sale invoice on the following page as a guide.

If a deposit is paid, make sure it is either listed on the private sale vehicle invoice or alternatively, make sure you get a receipt for the deposit from the seller. Once both parties have signed, it is now up to you to organise the funds to give to the seller. Once full payment has been made, make sure you get a receipt for this payment from the seller or have some kind of record of funds transfer.

It is up to you to make sure that all required paperwork is completed to transfer the registration into your name.

Make Sure Your Vehicle Is Insured

Before you drive away in your car, make sure you have adequate insurance. We cannot stress this point enough!

If you are confused about what types of insurance are available or which insurance is right for you, scroll down to read the next section on protecting yourself and your car or our friendly staff are always happy to help, give us a call on 1300 CREDIT to discuss your options.

We can help you to be protected from the unexpected by arranging your insurance from a variety of carefully selected insurance options by Australia's leading insurers.

7. Protecting You & Your Vehicle

If you’ve followed the steps outlined in this guide, you can enjoy your car knowing that you’ve done everything you can to ensure you made a great buying decision and selected the right car.

It’s now up to you to keep it maintained and in good condition. The good news is that we’re here to help with that as well. Our specialists understand that everyone is different, so we wanted to make it simpler for you to choose the options of cover best suited to your needs.

Related Reading: Car Maintenance Tips

Extended Vehicle Warranty

Did you know that it is possible to get a warranty for a used car as well as a new car? It is also possible to get a warranty for a vehicle you purchase privately. This can take a lot of the anxiety out of buying a private sale vehicle because you have the peace of mind of being backed by an Extended Vehicle Warranty on almost any car in Australia for up to 5 years.

An Extended Vehicle Warranty provides similar cover to a manufacturer warranty and various levels of cover are available for comprehensive repairs on the following mechanical and electrical components:

- Engine

- Transmission

- Steering

- Air conditioning and heating

- Engine cooling and fuel systems

- Electrical

- Instrumentation

- Anti-Lock brakes

- All electrical systems

- All engine management systems

- Torsions bars

- Engine mounts

- Suspension

- All liftgate, door & window

- mechanisms

- And much more

Thank you for reading our comprehensive 7 Easy Steps to Buying a Car Guide, we hope you’ve found it to be beneficial during your car-buying journey.

If you would like any further information on anything you’ve read in this guide including finance, insurance or warranties or would like to receive an obligation-free, personalised quote, please don’t hesitate to contact our finance and insurance specialists on 1300 CREDIT.

Related Reading

What Is A Hybrid & How Do They Work?

Once you've found the right car, the next step is sorting out car finance that actually works for your budget. Credit One is Australia's best-reviewed finance broker, with 3,000+ five-star Google reviews from customers who've been through the process. Check out Credit One reviews to see what people say, or head straight to the loan repayment calculator to see what the numbers look like.